Most of us end up selling time for money at a broad level. Except for people like authors, actors and people with some kind of intellectual property or investors, most of us, are generally selling time for money. Some might be selling it at a higher value than the others.

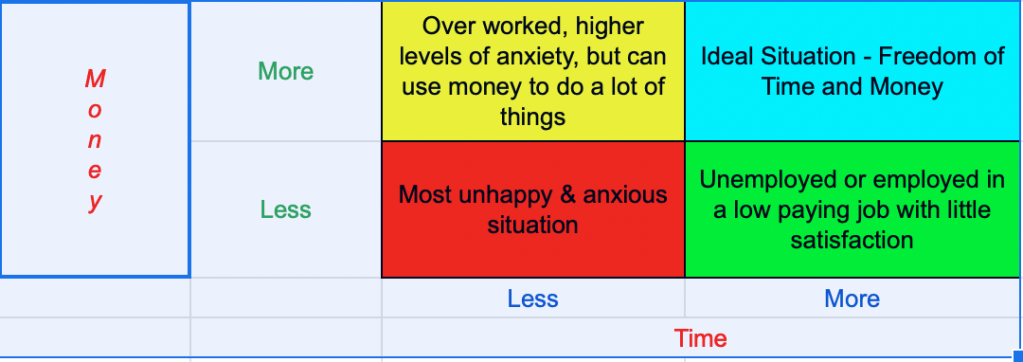

I was analysing various phases in my life and what my situation was. There was a time when I was overworked and with less income. We were always in an anxious state of mind. The ideal state where you have the freedom of time and freedom of money is the upper right corner in the picture.

Now I have not reached that situation of the blue box but I have at least moved from the bottom right hand corner box to the upper left. One of the reasons that could happen is because I started doing investments which started working for me in parallel to me selling time for money.

The earlier you can get involved in making investments – not savings (if you don’t know the difference, please see my my posts on financial freedom written in the earlier years) – the earlier you will reach this stage where you will not have to work at the same ratio. Obviously during this time as your experience grows your per hour rate at which you sell time could also grow.

The ideal situation is when you work once and you get paid multiple times over as in the case of movie actors and authors whose royalties keep coming. But for most of us who do not have any intellectual property to our credit – making investments in different types of assets is the only way to create a non linear relationship to time and money, such that your money works for you as hard as you work for the money.

Once your passive income grows to such a level where you don’t have to sell time for money that’s when you would reach the blue box area and have the freedom to do things of your choice. That’s the ideal place where I would like to eventually be, but lets see how it goes.